See below for this month’s Waterhouse VC newsletter. We specialise in global publicly listed and private businesses related to wagering and gaming.

Since inception in August 2019, Waterhouse VC has achieved a gross total return of 1,849% as at 31 January 2022, assuming the reinvestment of all distributions.

US regulation and taxation pushing away volume

On a recent trip to the US, we spoke with many US bettors who are incredibly frustrated with both the US online wagering experience and the US taxation system (regarding the treatment of winnings). Due to KYC/AML requirements, it is very cumbersome to set up and fund an online betting account. We do not envision this changing any time soon - if anything, this initial barrier to entry is likely to become more challenging for consumers.

Furthermore, according to the IRS’ website, wagering winnings are fully taxable and a bettor must report winnings as income on their tax return. Gambling spans lotteries, raffles, horse races, online sports betting and iGaming, and land-based sports betting and casinos.

An operator is required to issue bettors with a ‘Form W-2G, Certain Gambling Winnings’ if they receive certain gambling winnings. Whilst gambling losses may be deducted from income for tax purposes, the losses are only deductible off gambling winnings. This taxation system means that every US gambler is effectively forced to track their betting wins and losses to avoid being taxed on winnings. For example, if a bettor wins $1,000 and then loses $600, they must track this series of bets in order to only pay tax on the $400 of net winnings. If a bettor places 10 bets per week, an Excel with over 500 rows would likely be required to track the net result.

In addition, if more than $5,000 is won on a wager and the payout is at least 300x the amount wagered, the IRS requires the operator to withhold 24% of winnings for income taxes. Unique withholding rules apply to slot machines, keno, poker tournaments and bingo winnings.

These hurdles are pushing volume to unregulated operators, such as those operating in Costa Rica. There is not any specific online wagering legislation in Costa Rica so there are no barriers to establishing an operator in the country. Unregulated wagering websites are restricted from marketing directly to residents in heavily regulated countries, such as the UK and Australia. We have heard stories of US bettors regularly placing US$50,000+ wagers through Costa Rican bookmakers.

According to Costa Rican law, the physical location of an online wagering operator’s server is not where gambling actually takes place. Consequently, it’s legal for Costa Rican operators to offer online wagering services from Costa Rica so long as they do not offer them to residents of the region.

Undoubtedly, the US will try to clamp down on Americans betting through unregulated operators in Costa Rica and other jurisdictions. However, this will be no easy feat for US regulators, who already have to deal with the circa 40 domestic US operators.

Regulated operators (such as FanDuel, owned by Flutter) are able to develop strong brand awareness in the US through marketing channels unavailable to unregulated operators. FanDuel has market-leading brand awareness and user engagement. The company’s third quarter results illustrated their market leadership, with 18% market share of gross gaming revenue for iGaming and 42% share of online sports betting.

Unregulated operators carry a significant investment risk as they could lose a large portion of their customer base at any moment, whilst it is also increasingly challenging to effectively market them. Tax-paying regulated operators can help to form the general direction of regulation and lobby regulators. For example, we see many unregulated operators negotiating promotional/affiliate deals with celebrities (such as UFC fighters, rappers, ex-football players, etc.). FanDuel and other US operators could lobby regulators and state governments to ban celebrities from accepting such deals. If this occurs, unregulated operators would lose a crucial customer acquisition channel.

Regulated operators like FanDuel are well-positioned to compete with unregulated operators because they have larger marketing budgets, decades of experience and many customer acquisition channels, amongst several other key advantages. One of these advantages is the relatively easy access to capital from public markets.

Fluttering with a US listing

We have discussed Flutter in several prior newsletters (See November 2022, September 2021, January 2021). It has been a core portfolio holding since September 2019.

Flutter has long been listed in the UK and is the 27th largest company by market capitalisation. The company’s logic behind a US dual listing is three-pronged:

The US is now the firm’s largest revenue contributor.

A US listing improves access to US capital pools and makes it easier to offer share incentives to American employees.

US equities have long been valued at a premium P/E ratio compared to other global equity markets. Flutter’s shareholders would benefit from this uplift in P/E ratio, while the company could take advantage of a premium valuation to raise further capital.

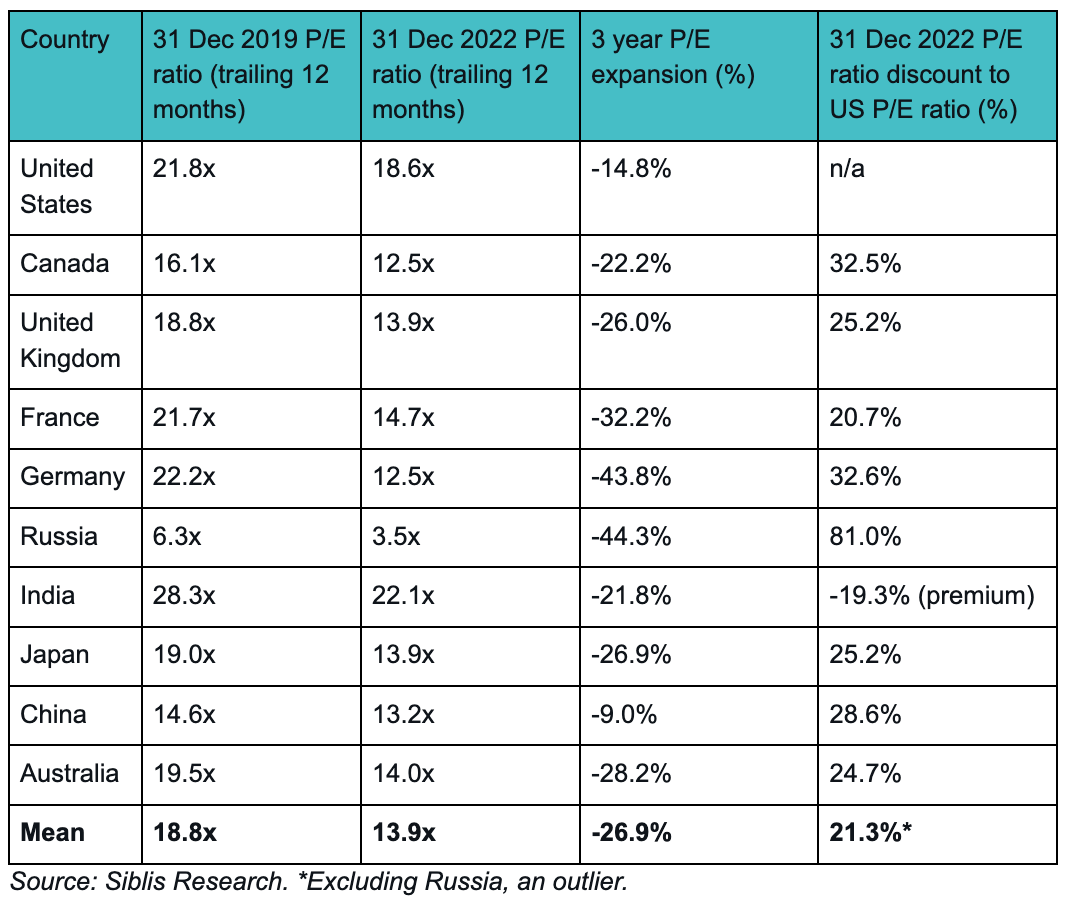

The table below shows the P/E ratios of the largest global markets, calculated using the benchmark equity index of each stock market.

As shown in the table, many global markets trade at a >20% discount to the US market, whilst the UK (most relevant to Flutter) trades at a 25% discount. Over the last three years, as interest rates have risen globally, P/E ratios have compressed an average of 27%. In comparison, the P/E ratio of the US market has compressed just 15%.

Flutter is certainly making marketing waves in the US, with a US$7m Super Bowl commercial offering US$10m of free bets. A vote on the US listing would require a 75% approval rate at Flutter’s April annual meeting. We view Flutter’s US listing aspirations as another example of their genuine commitment to remaining the market leader in US wagering. As at 20 February, Flutter is up +20% this calendar year to date.

Media

I will be speaking at iGaming NEXT New York on March 7-9th about 'Trends Driving M&A Activity in US Sports Betting + iGaming'. Register here.

For wholesale investors interested in following wagering and gaming industry news and trends, please follow our updates on Twitter (@waterhousevc) or through our website at WaterhouseVC.com.

DISCLAIMER AND IMPORTANT NOTES

Please note the above information in relation to Flutter is based on publicly available information in relation to the company and should not be considered nor construed as financial product advice. Waterhouse VC has a position in Flutter. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

General Information Only

This material is for general information only and is not an offer for the purchase or sale of any financial product or service. The material has been prepared for investors who qualify as wholesale clients under sections 761G of the Corporations Act or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The material is not intended to provide you with financial or tax advice and does not take into account your objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by Sandford Capital, Waterhouse VC or any other person. To the maximum extent possible, Sandford Capital, Waterhouse VC or any other person do not accept any liability for any statement in this material.

Financial Regulatory Oversight and Administration

Waterhouse VC is an Australian Unit Trust denominated in AUD and available to wholesale institutional investors worldwide with a minimum of AUD 1,000,000 or USD / EUR / GBP / JPY / CHF equivalent. This material has been prepared by Waterhouse VC Pty Ltd (ABN 48 635 494 861) (‘Waterhouse VC’, ‘Trustee’, ‘us’ or ‘we’) as the Trustee of the Waterhouse VC Fund (the ‘Fund’). The Trustee is a corporate authorised representative (CAR 1296688) of Sandford Capital Pty Limited (ABN 82 600 590 887) (AFSL 461981) (Sandford Capital) and appoints Sandford Capital as its AFS licensed intermediary under s911A(2)(b) of the Corporations Act 2001 (Cth) to arrange for the offer to issue, vary or dispose of units in the Fund.

Performance

Past performance of Waterhouse VC is not a reliable indicator of future performance. Waterhouse VC Pty Ltd does not guarantee the performance of any strategy or the return of an investor’s capital or any specific rate of return. No allowance has been made for taxation, where applicable. We encourage you to think of investing as a long-term pursuit.

Copyright

Copyright © Waterhouse VC Pty Ltd ACN 635 494 861. No part of this message, or its content, may be reproduced in any form without the prior consent of Waterhouse VC.

Governing Law

These Terms and Conditions of use are governed by and are to be construed in accordance with the laws of New South Wales. By accepting these Terms and Conditions of use, you agree to the non-exclusive jurisdiction of the courts of New South Wales, Australia in respect of any proceedings concerning these Terms and Conditions of use.