Welcome to the November 2020 newsletter for the Waterhouse VC Fund.

The Fund specialises in gambling assets and businesses that are related to the gambling industry. We aim to leverage our unique expertise and existing assets to generate yield and capital growth for investors over the long-term.

Since inception in August 2019, the Waterhouse VC Fund has achieved a total return of 553.4%, as at 31 October 2020.

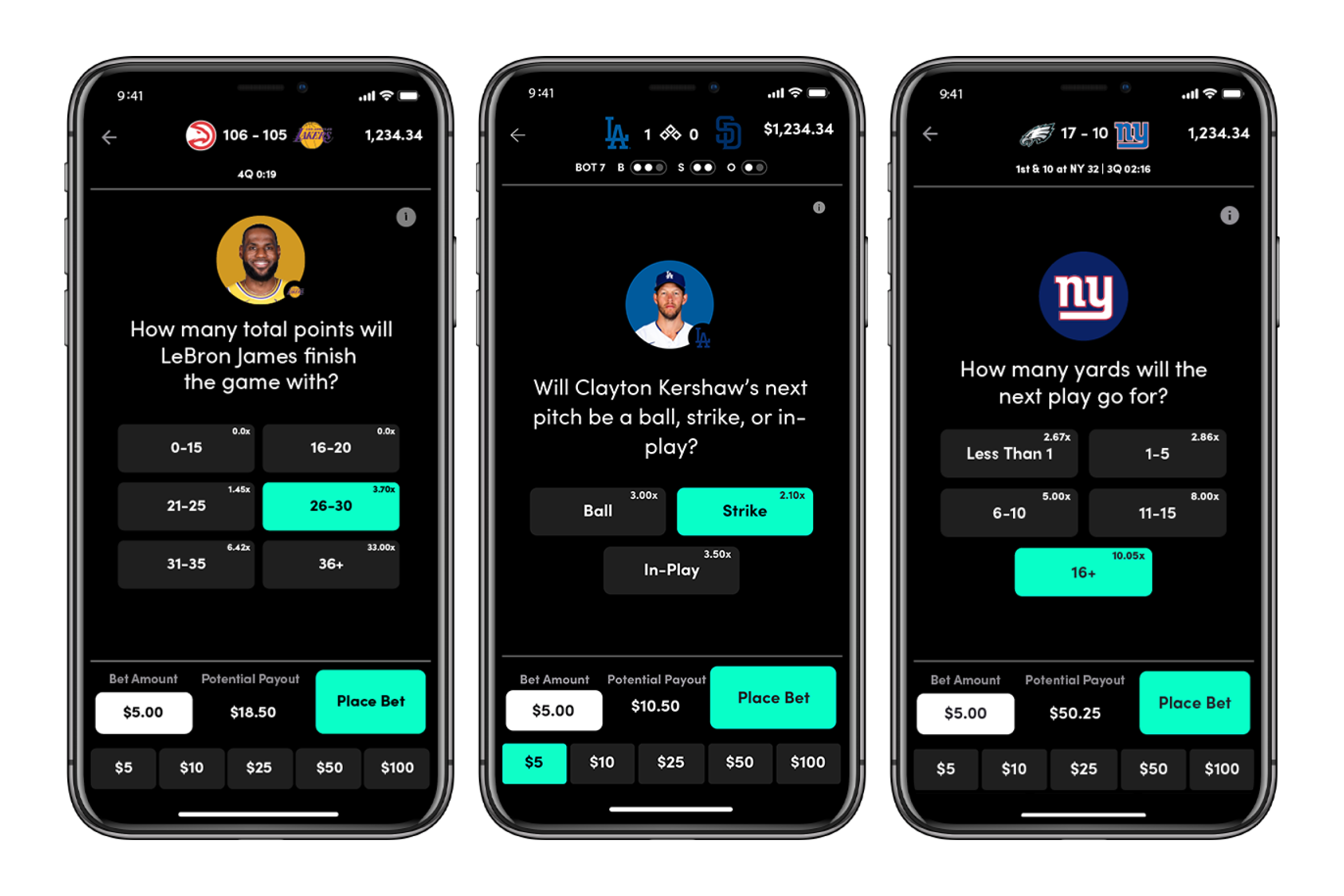

Making in-play betting simple

A growing form of sports betting content in the U.S., which we don’t have in Australia due to regulations, is online in-play betting. In-play betting refers to wagers that are placed throughout the game, instead of before, and it’s not just for punters who forget to place their bets before kick-off. In-play betting is used for hedging, arbitrage, and getting better odds if you think your team can come from behind to win.

In mature European markets, about 70% of all sports betting turnover is in-play, and we believe the stop-start nature of the major US sports provides a great backdrop for a thriving in-play market. Currently, there are few in-play markets offered beyond your traditional win/loss/draw, total points or over/under markets, due to the difficulty in pricing and managing these markets in real-time. When one pass, shot or run can change the course of a game, having a reliable and fast algorithm to take bets is critical.

A startup in the U.S. called Simplebet has set out to solve this problem, offering a business-to-business (B2B) software product to corporate bookmakers that allows them to offer in-play ‘micro-markets’ to their end customers. They enable every moment, of every sporting event, to become a betting opportunity. Every pitch in a baseball game, every play in a football game, and every shot in a basketball game, and more.

Given the amount of data captured and obsessed over by sports commentators, it may come as a surprise that this depth of betting product isn’t already there. It’s a very difficult problem to solve, especially the logistical difficulties associated with having traders glued to the screens to open, suspend, close and result in almost an infinite amount of markets in real-time.

Simplebet’s software takes official live data feeds from companies like Sportradar and feeds them through their models to reprice odds for these micro-markets in real-time. With the level of automation developed, there’s no need for human traders. In effect, it enables sports betting to become similar to online casino gaming, in terms of frequency of the content and instant gratification in outcomes.

Like many of our B2B investments, Simplebet plays a B2B role and customers are unaware of the software working away in the background. They just clip the ticket on the net gaming revenue (NGR) earned through the micro-markets betting.

Simplebet’s biggest partnership to date is with FanDuel’s PlayAction, a free-to-play game where customers can wager on NFL in-play micro-markets. The initial numbers speak for themselves:

The average user is betting 27.88 times per Primetime game and 46.18 times per Sunday slate

The average user session duration is 26.17 minutes per Primetime game

Over 9% of users are spending over 2 hours on the FanDuel app per Primetime game

22% week-to-week retention

These in-play bet types are clearly more appealing to casual punters, who lose at a higher margin than serious gamblers. By increasing their engagement and keeping them in the betting apps for longer, Simplebet’s software can increase the lifetime value of customers for corporate bookmakers. No doubt the FanDuel partnership is being used as a case study to attract more partnerships in the future.

In the highly competitive U.S. market, maximising the number of betting options and markets alongside innovative bet types will be a massive determinant of product leadership and therefore market leadership.

For wholesale investors that want to follow gaming’s global growth, please follow us for updates on Twitter @waterhousevc.

Please note the above information in relation to Simplebet and Sportradar is based on publicly available information in relation to each of them and should not be considered nor construed as financial product advice. The Fund currently doesn't have a position in Simplebet. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.