Waterhouse VC is a fund that specialises in global publicly listed and private businesses related to wagering and gaming sectors. The fund is only available to wholesale investors.

Since inception in August 2019, Waterhouse VC has achieved a gross total return of +3,162% (annualised at 95.4%), as at 31 October 2024, assuming the reinvestment of all distributions.

New Era for Prediction Markets

As the dust settles on the U.S. election, prediction markets have captured attention far beyond traditional wagering circles. Polymarket has taken centre stage, showcasing the potential for decentralised platforms to revolutionise forecasting and betting.

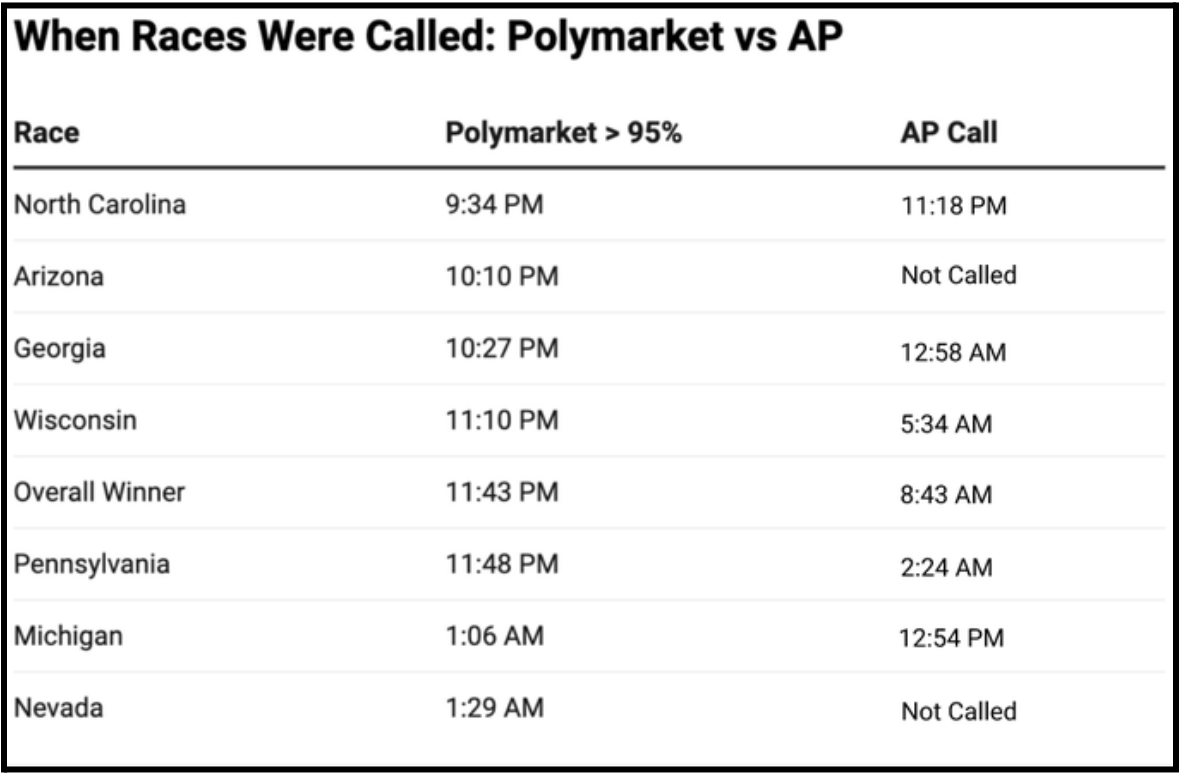

Polymarket handled over $3.6 billion on wagers on the election outcome, accurately predicting not only the President but also the results in every swing state - well ahead of the Associated Press.

Polymarket accurately predicted Swing States well ahead of the Associated Press. Source: X

Prediction markets are judgement-based platforms designed to forecast the likelihood of future events. Operating on the principle of the efficient market hypothesis - the idea that market prices aggregate and reflect all available information, participants buy and sell contracts tied to specific outcomes, such as elections, sports, or economic indicators.

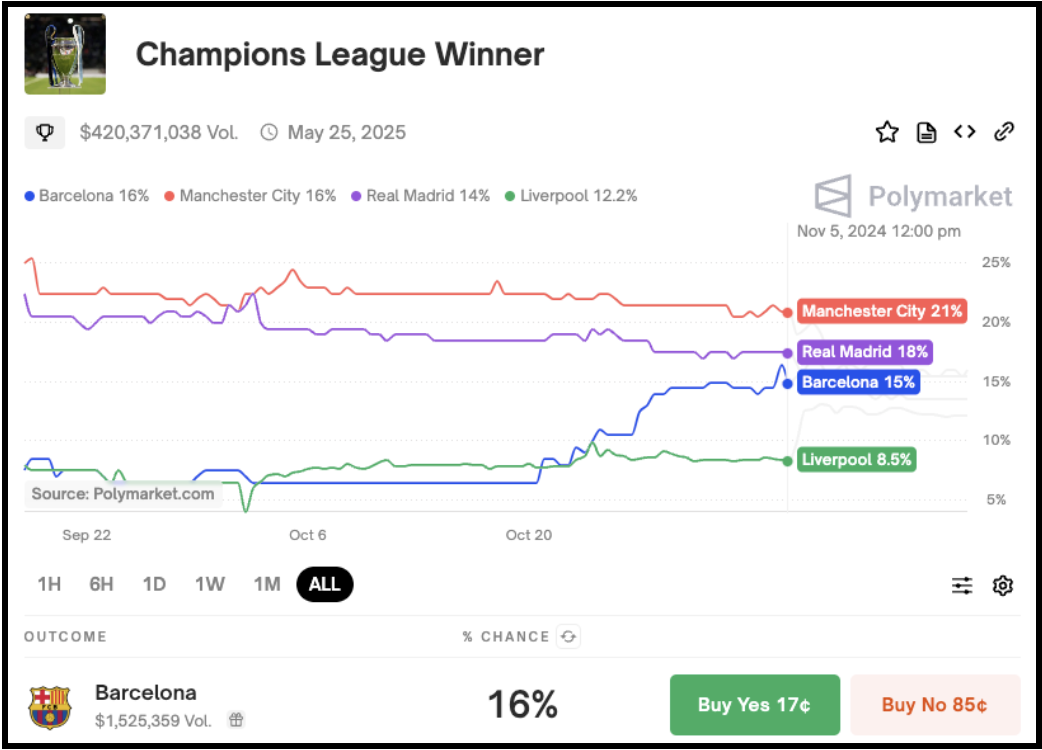

Typically structured as binary ‘yes or no’ wagers, the price at any given moment represents the market's collective assessment of the probability of that outcome occurring. For example, if Real Madrid are trading at 14¢ in a Champions League Winner market, it reflects a 14% chance of them winning. Price = Probable Truth.

The Champions League Winner Market currently has over $420 million of wagering handle. Source: Polymarket

Once an event concludes, outcomes are settled in binary form based on official results, with correct shares paying out fully, while incorrect ones hold no value.

Liquidity is lifeblood

Liquidity is essential for any market to thrive, attracting and sustaining active participation. In prediction markets, liquidity fosters a diverse ecosystem of participants - from casual speculators to informed experts. This diversity creates a robust mechanism for aggregating insights, with individual trades continuously refining probabilities in real time.

The result produces a phenomenon known as the ‘wisdom of the crowds’ effect, often surpassing the accuracy of individual expert opinions. As James Surowiecki, put it:

‘Groups are remarkably intelligent, and are often smarter than the smartest people in them’.

Despite their potential, prediction markets rely on sustained user engagement. Historically, platforms have struggled to sustain activity beyond major headline events, limiting their capacity to provide consistently actionable insights. Without ongoing activity, markets risk stagnation, undermining their purpose as real-time forecasting tools.

Today, a new wave of platforms, most notably Polymarket and Kalshi, are looking to overcome these challenges. Both platforms have surged in popularity during the U.S election, drawing unprecedented volumes of traded contacts. While much of this activity was driven by the election, the current liquidity for other markets suggests there may be a path to a sustained role in the wider wagering landscape.

Polymarket

Founded in 2020 by Shayne Coplan, Polymarket has quickly made headlines as a blockchain-powered prediction market, allowing users to speculate on outcomes across sports, pop culture, politics and science. The U.S. election was a defining moment, with trading volumes exceeding $3.6 billion, surpassing the combined $2.5 billion in presidential campaign fundraising. For comparison, during the 2020 election (Polymarket’s first year), the platform had $10 million in trading volume on the outcome, with users accurately predicting Joe Biden’s victory.

2024 Presidential Winner Market Volume (Millions) Source: X

Shayne Coplan

Coplan learnt to code as a teenager and was reportedly the youngest participant in the initial sale of Ethereum, purchasing the cryptocurrency when it traded for just 30 cents—a fraction of its current value. He studied computer science at New York University but left before graduating to pursue his interests in crypto. It was this leap of faith that resulted in Polymarket.

Shayne Coplan’s makeshift bathroom office in 2020. Source: X

Polymarket founder Shayne Coplan showing the platform's broader impact. Source: X

Advantages of Decentralisation

Polymarket operates on blockchain technology with users trading via the USDC stablecoin. This system offers instant, verifiable, and cost-effective transactions, eliminating the delays and chargeback risks of traditional card payments. For users, the platform ensures privacy - transactions don’t appear on bank statements - and avoids the fees typically associated with deposits, withdrawals, or trades.

As a decentralised exchange, Polymarket attracts a global audience and imposes no trading limits, instead it matches willing buyers and sellers of any amount. This is especially attractive to high-volume participants and underscores why liquidity is vital for a market to thrive. Smart contracts, self-executing programs embedded within the blockchain ensure transparent and automated settlements, streamlining operations and reducing costs for everyone involved.

Blockchain also provides an immutable ledger of transactions, giving users a real-time view of bets and market movements. There is also a leaderboard for trading volume and profit for individual users, which provides details on each of their trades. One standout participant has been a French speculator, identified as ‘Théo’ who reportedly earned $85 million from bets on Donald Trump’s victory.

Unlike traditional betting exchanges, Polymarket operates without jurisdiction turnover taxes, commissions, or premium charges (which often target profitable bettors). This fee-free structure creates an appealing environment for participants, providing optimal conditions for higher trading volumes and liquidity.

Prediction markets and betting sites were a step ahead of traditional news outlets. Source: predictionnews.com

Prediction markets can outperform traditional guides, such polls or media analysis as they can adapt dynamically to new information, offering a more accurate and responsive snapshot of sentiment. The 2016 Presidential election highlighted the limitations of legacy information sources. The New York Times famously gave Hillary Clinton an 85% chance of winning on election morning, based on state and national polls - an assessment that failed to capture shifting dynamics.

In the lead-up to the election, Polymarket, alongside prediction platforms, Kalshi and Predictit, gave Trump a roughly 60% chance of winning, while traditional polls struggled to split the candidates.

Keeping it Simple

Wagering has always been part of the human-psyche, and prediction markets, in their simplicity cater seamlessly to this behaviour. Fractional odds set by bookmakers, while mathematically translatable to probabilities, lack the immediate clarity that prediction markets provide. This simplicity, combined with the savvy use of social media, and television appearances from Shayne Coplan have helped form a truly global community.

X, known for its opinion-driven discourse, has been particularly effective in amplifying this engagement. Regular endorsements from Elon Musk who has over 205 million followers is an incredibly powerful and cheap tool for driving users, interest and ultimately liquidity to the platform. Even Donald Trump was referencing Polymarket on X, creating a level of publicity that other wagering operators, or even any business, could only dream of achieving.

Trading volumes for Jake Paul vs Mike Tyson exceed $57 million showing that Polymarket’s well positioned to be a major force in global gambling. Source: X

Free publicity for Polymarket from the future and former President on X. Source: X

Challenges

Despite Polymarket’s position as the world’s largest prediction market, U.S. users are currently restricted from using the platform, following a 2022 ruling from the Commodity Futures Trading Commission (CFTC). Kalshi, its nearest competitor, is CFTC-compliant, but is currently only available to US residents.

Polymarket’s success has also drawn scrutiny. Following the election, the FBI raided Shayne Coplan’s Manhattan residence, seizing electronic devices including his phone, which Coplan attributed on X to the current administration, suggesting it was a means of political retribution for Polymarket’s accurate election predictions.

Mainstream Use-Case for Crypto

Backed by influential investors like Peter Thiel and Ethereum co-founder Vitalik Buterin, Polymarket has raised $70M to date. Their success underscores how great products can overcome barriers to crypto adoption. Although crypto, smart-contracts and blockchain underpin the platform, Polymarket’s simplicity, and engaging user experience were key in drawing a broader audience.

The key challenge for prediction markets will be maintaining engagement levels. Replicating the intensity of election-driven interest will be tough but with sustained effective marketing, and interesting markets to speculate on, prediction markets can have a sustained future in a wider wagering world.

Polymarket daily trading volume spiking during the election. Source: Dune Analytics

Media

For those that missed our September webinar, catch up on the recording here. Tune in for review of the fund's five-year track record, recent option deals added to the portfolio, and the current opportunities we’re seeing in the wagering industry.

Watch a recent discussion about the Melbourne Cup carnival’s significance to the industry, and Flutter’s recent quarterly results.

For wholesale investors interested in following wagering and gaming industry news and trends, please follow our updates on Twitter (@waterhousevc) or through our website at WaterhouseVC.com.

All the best,

Tom

DISCLAIMER AND IMPORTANT NOTES

Please note the above information in relation to Polymarket, Shayne Coplan, Associated Press, FanDuel, Betfair, CFTC, Predictit, Kalshi, Smarkets, Predictionnews.com, X, Dune Analytics, FBI, Peter Thiel, James Surowiecki, Vitalik Buterin, Elon Musk, and Caanberry is based on publicly available information and should not be considered nor construed as financial product advice. The fund currently has a position in Flutter Entertainment Plc. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

Not for Release or Distribution in the United States of America

This material may not be released or distributed in the United States. This material does not constitute an offer to sell, or a solicitation of an offer to buy, any securities in the United States or any other jurisdiction in which such an offer would be illegal. The units in the Fund have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the U.S. Securities Act) or the securities laws of any state or other jurisdiction of the United States. Accordingly, the units in the Fund may not be offered or sold in the United States unless they are offered and sold, directly or indirectly, in transactions exempt from, or not subject to, the registration requirements of the U.S. Securities Act and any other applicable United States state securities laws.

General Information Only

This material is for general information only and is not an offer for the purchase or sale of any financial product or service. The material has been prepared for investors who qualify as wholesale clients under sections 761G of the Corporations Act or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The material is not intended to provide you with financial or tax advice and does not take into account your objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by Sandford Capital, Waterhouse VC or any other person. To the maximum extent possible, Sandford Capital, Waterhouse VC or any other person do not accept any liability for any statement in this material.

Financial Regulatory Oversight and Administration

Waterhouse VC is an Australian Unit Trust denominated in AUD and available to wholesale institutional investors worldwide with a minimum of AUD 500,000 or USD / EUR / GBP / JPY / CHF equivalent. This material has been prepared by Waterhouse VC Pty Ltd (ABN 48 635 494 861) (‘Waterhouse VC’, ‘Trustee’, ‘us’ or ‘we’) as the Trustee of the Waterhouse VC Fund (the ‘Fund’). The Trustee is a corporate authorised representative (CAR 1278656) of Sandford Capital Pty Limited (ABN 82 600 590 887) (AFSL 461981) (Sandford Capital) and appoints Sandford Capital as its AFS licensed intermediary under s911A(2)(b) of the Corporations Act 2001 (Cth) to arrange for the offer to issue, vary or dispose of units in the Fund.

Performance

Past performance of Waterhouse VC is not a reliable indicator of future performance. We make every endeavour to ensure results are accurate. Waterhouse VC Pty Ltd does not guarantee the performance of any strategy or the return of an investor’s capital or any specific rate of return. No allowance has been made for taxation, where applicable. We encourage you to think of investing as a long-term pursuit. Waterhouse VC’s results are indicative only and subject to subsequent year end external financial review.

Copyright

Copyright © Waterhouse VC Pty Ltd ACN 635 494 861. No part of this message, or its content, may be reproduced in any form without the prior consent of Waterhouse VC.

Governing Law

These Terms and Conditions of use are governed by and are to be construed in accordance with the laws of New South Wales. By accepting these Terms and Conditions of use, you agree to the non-exclusive jurisdiction of the courts of New South Wales, Australia in respect of any proceedings concerning these Terms and Conditions of use.