Waterhouse VC is a fund that specialises in global publicly listed and private businesses related to wagering and gaming sectors. The fund is only available to wholesale investors.

Since inception in August 2019, Waterhouse VC has achieved a gross total return of +3,028% (annualised at 95.8%), as at 30 September 2024, assuming the reinvestment of all distributions.

The Flutter Edge

In the world of wagering, few names carry as much weight as Flutter Entertainment. This month, we explore the origins, key figures and pivotal decisions which have driven its success, and how the 'Flutter Edge' - Product, Technology, Expertise, and Scale - continues to position the company as the dominant force in global wagering.

Bold Power

Before Flutter Entertainment, there was Paddy Power. Founded in 1988 through a merger of forty betting shops owned by Stewart Kenny, David Power, and John Corcoran, Paddy Power quickly gained popularity for its witty, provocative and often controversial advertising campaigns.

Under Patrick Kennedy’s leadership, who became CEO in 2006 after serving on the board, Paddy Power became a major player in global wagering. Kennedy embraced Stewart Kenny’s vision of being the ‘punter’s pal’, offering a wider range of betting products (no matter how trivial), better odds, and a fairness-first approach, where any 50/50 decision favoured the punter. The approach built strong brand loyalty, setting it apart from its UK competitors.

Nicklas Bendtner celebrating his goal during the 2012 Euros in his Paddy Power lucky pants. He was fined €100,000 for the stunt. Source: Paddy Power

Paddy Power appointed a ‘head of mischief’ to lead attention-grabbing marketing stunts. During the 2014 World Cup, despite not being an official sponsor, Paddy Power became the seventh most mentioned brand in the world. No other operator has been able to entertain and engage through social media quite like Paddy Power. Their campaigns often have little to do with betting, instead they put a humorous spin on trending topics which has helped establish the brand as a household name, driving down customer acquisition costs.

Exceptional Talent

Kennedy’s experience, which included time at McKinsey and KPMG, taught him that hiring exceptional talent was key to outperformance. When he joined, Paddy Power had 1,500 employees; by the end of his tenure in 2015, that number had grown to over 5,000. A diverse talent pool kept Paddy Power ahead of the curve in an evolving digital and regulatory landscape. For example, in May 2010 they were the first operator to launch an app on the Apple iPhone, securing first-mover advantage in mobile betting; it took some time before other operators followed suit.

Winner of Oz

A pivotal move during Kennedy’s tenure was the acquisition of Australian operator Sportsbet, which set the blueprint for future international success. The opportunity arose following the 2008 High Court decision that relaxed interstate advertising restrictions for betting operators. Paddy Power was swift to act, acquiring an initial 51% stake in Sportsbet for A$48.5M in May 2009. The deal also included IASbet, Australia’s 3rd largest operator, which Sportsbet had recently acquired. By March 2011, they had secured full ownership, with the total investment amounting to less than A$230M.

By 2014, Paddy Power had shifted from 80% domestic and retail revenue to 80% international and online. Today, Sportsbet has 2m+ customers and controls 42% of Australia’s wagering market, generating $1.4 billion in revenue for 2023.

Merger Rationale

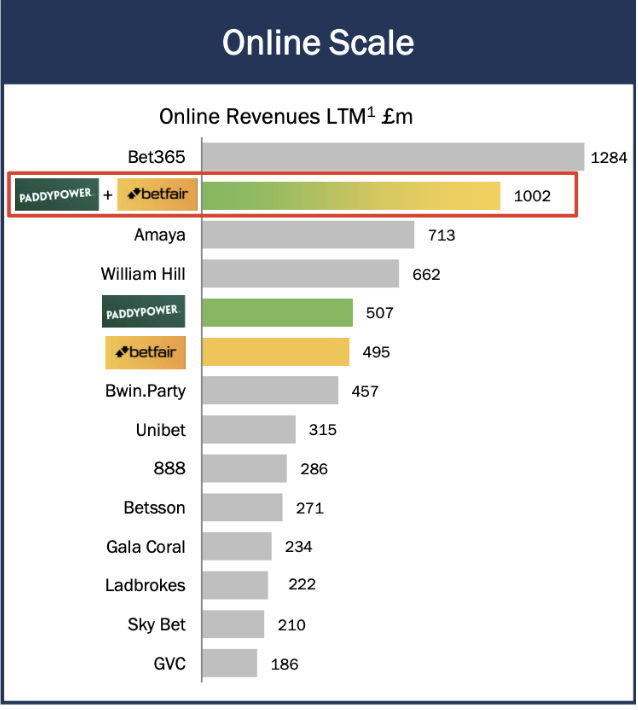

The digital era brought increasing fixed costs, stricter regulatory requirements (often in the form of higher taxes), and rising distribution expenses due to omni-channel approach. In a high-tax environment, operational leverage becomes critical for maintaining profitability. Scale allows businesses to spread fixed costs and tax burdens more effectively, making mergers attractive for growth. Deals like GVC acquiring Bwin (£1.12B) and Ladbrokes joining forces with Coral (£2.3B), highlighted the growing trend of consolidation.

Betfair, who’d pioneered a revolutionary peer-to-peer betting exchange, offered a unique product that allowed users to bet against each other rather than the bookmaker. With stock market-like functionality, Betfair became indispensable for bookmakers in pricing events and managing risk.

Betfair founders Edward Wray and Andrew Black at HQ. Venture capitalists refused to back the initial 1M funding round. Source: The Times

In 2016, Breon Corcoran, CEO of Betfair and former Paddy Power COO, led a £5.7B merger, creating Paddy Power Betfair. Betfair brought 1.7M active customers, an online-only business model, and a technology-driven approach that aligned with Paddy Power's vision. Although Corcoran only spent two years as CEO of the newly merged entity, his influence on the future of Flutter cannot be understated.

Advantages of combining forces presented in a Prospectus December 2015 (Pre-Merger). Source: Flutter Entertainment Plc

Corcoran had spent a combined 16 years at both companies, giving him an intimate understanding of how to combine their strengths. Though today Betfair represents a smaller percentage of Flutter’s overall revenue, it remains the world’s biggest betting exchange. The scale that Corcoran helped achieve through the merger, laid the foundation for its future growth.

The Jackson Years

In January 2018, Peter Jackson took over as CEO, ushering in a new phase of strategic growth. The 2019 rebrand to Flutter Entertainment signalled ambitions far beyond a name change. Like his predecessors, Jackson came with board experience, having served at Paddy Power Betfair, and like Kennedy, he had a background at McKinsey. He had also served as CEO at Travelex and was also UK head at Worldpay.

Peter Jackson has overseen 11 deals since becoming CEO in 2018. Source: The Times

Jackson faced even stricter regulations and rising costs in previously high-growth markets like the UK, Ireland and Australia. At the same time, new opportunities arose as regulatory environments evolved in other regions. Jackson’s strategy focussed on two core components: scale (increasingly important) and diversification.

Jewel in the Crown

The most significant of these opportunities was the US market. The acquisition of FanDuel, a leader in US fantasy sports, has become Jackson’s defining move. In May 2018, the initial 58% stake cost just $158 million, with the deal announced just days after the Professional and Amateur Sports Protection Act (PASPA) was repealed. In December 2020, Flutter paid $4.2 billion for an additional 37%, cementing its dominant position in the US.

Repeat Success

FanDuel’s established presence in the US, with over a 40% share of the daily fantasy sports market, ensured that Flutter didn’t face the challenge of a ‘cold start’. FanDuel mirrored the success of the Sportsbet deal, where early-entry and backing the strongest local brand proved to be a winning formula. Today, Flutter controls 42% of the US sports betting market with an estimated 18m+ customers. US revenues are projected to reach $6.2 billion in 2024, with overall group revenue expected to hit $21 billion by 2027.

Along with scale, the need for diversification was increasingly clear. Not every product or portfolio business would be a long-term success. Evolving regulations in the form of affordability checks and higher taxes, introduced uncertainty. The potential for unfavourable sporting results, and the unpredictability of global macro events, underscored the importance of having a diversified portfolio to withstand these challenges.

The decline of Betfair exchange liquidity - highlighting the need for diversification. Source: Racing Post

Podium Positions

Diversification has been central to Flutter’s M&A strategy, with a focus on achieving ‘podium positions’ - securing top-three market share in all regulated markets. Jackson has been relentless in integrating local hero brands into the Flutter ecosystem.

The acquisition of PokerStars and Sky Bet through the £10 billion mega-merger with the Stars Group in 2020 exemplified this dual-strategy of scale and diversification. At the time, Flutter derived 75% of its revenues from sports betting. This acquisition expanded product offerings and significantly reduced reliance on sports-related income, a decision that proved pivotal during the Covid-19 pandemic when there was no sport to bet on. At the time, the deal delivered cost savings, projected in the region of £140 million per year.

Combined brands of the £10 billion merger with the Stars Group. Source Flutter Entertainment Plc

Other notable strategic acquisitions, such as Sisal (€1.91B) and Snaitech (€2.6B) have given Flutter the ‘gold medal’ position in Italy, with a 30% market share. Additionally, acquisitions like MaxBet in Serbia, Junglee Games in India, and Brazilian operator NSX Group, have enabled Flutter to diversify its product and grow rapidly across Europe and emerging markets.

Despite the high failure rate of mergers (estimated between 70% and 90% by Harvard Business Review), Flutter’s success in its acquisitions stands out. They have been able to pick up outstanding brands for valuations which, over time, have proven cheap. Each acquisition brings more than just market share—Flutter empowers these brands with cutting-edge product, risk management expertise, and proprietary content.

Flutter Entertainment revenue by region. Source: Flutter Entertainment Plc

Flywheel effect

These acquisitions have helped accelerate Flutter’s flywheel effect. It is scale that drives investment in product innovation, operational efficiency, and customer loyalty, which in turn generates further growth. The larger Flutter becomes, the more it can allocate resources toward enhancing technology, improving risk management, and refining customer experience—creating a self-reinforcing cycle of expansion and competitiveness, making it increasingly difficult for rivals to keep pace.

Flutter’s Flywheel. Source: Flutter Entertainment Plc

NYSE Listing

Alongside the acquisitions, Jackson led the dual-listing of Flutter on the New York Stock Exchange (NYSE:FLUT) in January this year. With FanDuel’s success and the growth of the US betting market, Jackson saw the US as the natural home for Flutter, with the North American total addressable market (TAM ) predicted to exceed $70 billion. The listing has bolstered Flutter’s presence in the US and the increased visibility among American investors has seen the share price has increased markedly this year, with Flutter’s market cap now exceeding $40 billion.

Peter Jackson and Rob Gronkowski on the New York Stock Exchange. Source: Flutter Entertainment Plc

Key Takeaways:

Differentiate: Paddy Power, built the foundation for Flutter’s success by standing out from its competitors. Focus on a core audience, savvy marketing, strategic M&A skills and execution are some of the factors that have allowed them to excel.

Strong Leadership: Patrick Kennedy, Breon Corcoran and Peter Jackson have shared a similar vision for the business throughout. They’ve hired the best, built leaders within the business and have never been complacent.

Learn from Mistakes: Few businesses are exempt from mistakes. Flutter’s recognition of the need for diversification both in geographies and product, as well as sticking to a formula for new markets, has driven growth.

Scale Matters: Flutter’s dominance across multiple regions demonstrates the power of scale in digital businesses. In highly regulated and heavily taxed environments, operational leverage is critical. Scale allows Flutter to optimise costs, increase efficiency, and remain competitive in markets with high tax burdens.

Media

For those that missed our September webinar, catch up on the recording here. Tune in for review of the fund's five-year track record, recent option deals added to the portfolio, and the current opportunities we’re seeing in the wagering industry.

Learn more about Flutter and Waterhouse VC’s focus on Picks & Shovel Opportunities in this interview with Ausbiz. Learn more about Waterhouse VC’s strategic investment in Racing and Sports in this interview with Talk Ya Book.

For wholesale investors interested in following wagering and gaming industry news and trends, please follow our updates on Twitter (@waterhousevc) or through our website at WaterhouseVC.com.

All the best,

Tom

DISCLAIMER AND IMPORTANT NOTES

Please note the above information in relation to Flutter Entertainment Plc, Paddy Power, Betfair, Paddy Power Betfair, Patrick Kennedy, Breon Corcoran, Andrew Black, Edward Wray, Peter Jackson, McKinsey & Company, Travelex, GVC, BWin, Ladbrokes, Coral, Ladbrokes Coral, Sisal, Junglee Games, MaxBet, FanDuel, Stars Group, PokerStars, Sky Bet, Snaitech, NSX group, Harvard Business Review, Rob Gronkowski, New York Stock Exchange and RAS Technology Holdings is based on publicly available information in relation to the company and should not be considered nor construed as financial product advice. The Fund currently has a position in RAS Technology Holdings and Flutter Entertainment Plc. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

Not for Release or Distribution in the United States of America

This material may not be released or distributed in the United States. This material does not constitute an offer to sell, or a solicitation of an offer to buy, any securities in the United States or any other jurisdiction in which such an offer would be illegal. The units in the Fund have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the U.S. Securities Act) or the securities laws of any state or other jurisdiction of the United States. Accordingly, the units in the Fund may not be offered or sold in the United States unless they are offered and sold, directly or indirectly, in transactions exempt from, or not subject to, the registration requirements of the U.S. Securities Act and any other applicable United States state securities laws.

General Information Only

This material is for general information only and is not an offer for the purchase or sale of any financial product or service. The material has been prepared for investors who qualify as wholesale clients under sections 761G of the Corporations Act or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The material is not intended to provide you with financial or tax advice and does not take into account your objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by Sandford Capital, Waterhouse VC or any other person. To the maximum extent possible, Sandford Capital, Waterhouse VC or any other person do not accept any liability for any statement in this material.

Financial Regulatory Oversight and Administration

Waterhouse VC is an Australian Unit Trust denominated in AUD and available to wholesale institutional investors worldwide with a minimum of AUD 500,000 or USD / EUR / GBP / JPY / CHF equivalent. This material has been prepared by Waterhouse VC Pty Ltd (ABN 48 635 494 861) (‘Waterhouse VC’, ‘Trustee’, ‘us’ or ‘we’) as the Trustee of the Waterhouse VC Fund (the ‘Fund’). The Trustee is a corporate authorised representative (CAR 1278656) of Sandford Capital Pty Limited (ABN 82 600 590 887) (AFSL 461981) (Sandford Capital) and appoints Sandford Capital as its AFS licensed intermediary under s911A(2)(b) of the Corporations Act 2001 (Cth) to arrange for the offer to issue, vary or dispose of units in the Fund.

Performance

Past performance of Waterhouse VC is not a reliable indicator of future performance. We make every endeavour to ensure results are accurate. Waterhouse VC Pty Ltd does not guarantee the performance of any strategy or the return of an investor’s capital or any specific rate of return. No allowance has been made for taxation, where applicable. We encourage you to think of investing as a long-term pursuit. Waterhouse VC’s results are indicative only and subject to subsequent year end external financial review.

Copyright

Copyright © Waterhouse VC Pty Ltd ACN 635 494 861. No part of this message, or its content, may be reproduced in any form without the prior consent of Waterhouse VC.

Governing Law

These Terms and Conditions of use are governed by and are to be construed in accordance with the laws of New South Wales. By accepting these Terms and Conditions of use, you agree to the non-exclusive jurisdiction of the courts of New South Wales, Australia in respect of any proceedings concerning these Terms and Conditions of use.